Several years ago Europe proposed a tax on meat. Specific countries have taken action or floated policies, for example last year in Denmark. European researchers continue to advocate for higher meat pricing. A 2023 survey showed public support for a meat tax in western Europe, and some say such a tax is inevitable. The reasoning is plain. Meat, especially beef and lamb, has a large carbon footprint. Furthermore, eating too much meat with high levels of saturated fat, cholesterol, and nitrates can lead to health problems. It is better for the planet and for the body to eat more modest amounts.

The agricultural industry is working to reduce meat emissions by deploying digesters to process waste and using feed additives to curb methane in burps. But we can also nudge on the demand side with a tax. The proceeds could be distributed in a variety of ways to ensure the new charge does not unduly impact lower-income households.

I am intrigued by this idea. Price signals are effective and I agree that we would be better off eating less meat. That is not only for climate and health reasons, but also because of the impact on water quality of some of the large cattle lots and because of the ethical issues with confining and slaughtering so many animals. I don’t see much downside if the tax is designed well.

Related taxes on sugary drinks (in several US cities), on "junk food" (in Mexico), and on high-fat foods (in Denmark) have reduced consumption of the taxed items. But big questions remain. Acceptability is the overriding concern. The tax in Denmark was repealed after just a year because it did not have enough support. Several attempts at food taxes have failed to get off the ground at all, especially in the United States where many view them as paternalistic.

Another concern is increased uptake of untaxed alternatives. For example, one study of Philadephia’s tax on sugar-sweetened beverages showed that people drank less of the taxed beverages, but they ate more of other sugary foods and of untaxed sugar-sweetened beverages in neighboring areas, which offset a portion of the gains. Similarly, in Mexico, people subject to a tax on junk food drank more homemade sugary drinks (e.g., agua frescas) and consumed more processed meats and desserts, again partially offsetting the effects of the tax. Moreover, the effectiveness of these taxes on health outcomes, as opposed to consumption, has been hard to tease out.

There have been concerns about the regressive impact of these taxes -- they can hit lower-income households harder, particularly if demand is not sufficiently elastic. But a recent study of designs for a meat tax in Europe shows there are some good options to reduce and even fully counteract this effect. Wealthier households consume more expensive cuts of meat, so a tax based on the value of the meat purchased, rather than (say) the number of pounds or emissions, is more progressive.

The authors also found that if the tax revenue is returned to households as an equal lump-sum payment rather than (say) provided as a subsidy for fruits and vegetables, lower-income households fare especially well. That effect is so big that it even counteracts a tax based on the carbon footprint of each type of meat, which turns out to be more regressive. A meat tax based on greenhouse gas intensity would dissuade consumers from switching from (say) pricy chicken breasts to less expensive but higher emission ground beef.

I see potential in this idea. It is cheaper to reduce emissions by changing our diet than by retrofitting our HVAC systems, and there are terrific co-benefits around health, water quality, and animal welfare. The younger generations see this -- a 2022 survey in the US showed that 62% of Gen Z respondents would support a 10% meat tax. But that same survey showed only 37% support in the general population. Perhaps that will increase over time. For now despite plausible design options it seems this type of tax is off the table. I think that is a lost opportunity. What do you think?

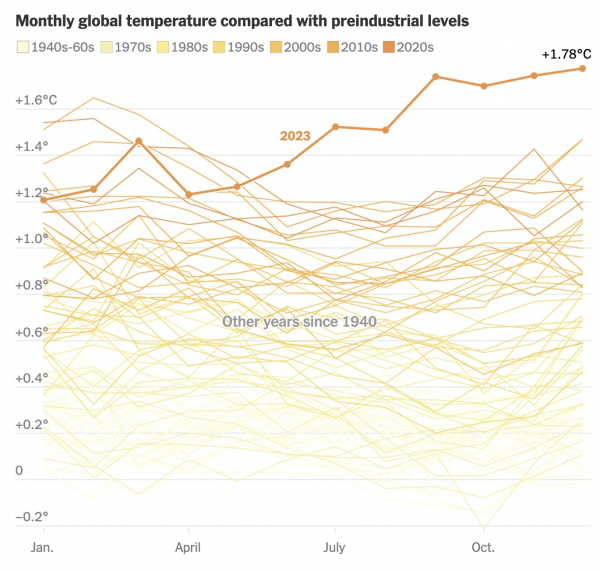

Current Climate Data

Global impacts (November 2023), US impacts (November 2023), CO2 metric, Climate dashboard

Comment Guidelines

I hope that your contributions will be an important part of this blog. To keep the discussion productive, please adhere to these guidelines or your comment may be edited or removed.

- Avoid disrespectful, disparaging, snide, angry, or ad hominem comments.

- Stay fact-based and refer to reputable sources.

- Stay on topic.

- In general, maintain this as a welcoming space for all readers.