The Hoover Institution held a day-long conference last week titled “Markets vs Mandates”, specifically focused on the environment. Many topics were discussed, including adaptation, ESG investing, and climate misinformation, but there was a terrific panel on environmental markets led by Nick Parker, a Hoover Visiting Fellow and professor of applied economics at University of Wisconsin-Madison. Several other speakers also weighed in on the topic. So this blog post discusses the question: Which makes for more effective environmental policy, mandates or markets?

A mandate is a regulation that establishes and enforces an environmental goal. It might reduce air or water pollution (e.g., the Clean Air Act), protect land or marine wildlife (e.g., the Endangered Species Act), or address something else (e.g., the Montreal Protocol protecting the ozone layer). Many of these regulations have been very effective -- law is enforceable and not particularly malleable. When we created a regulation to phase out lead-based gas, manufacturers and service stations adapted and it was gone within 15 years. Mandates are often appealing because they directly eliminate a scourge, whether it is over-hunting or under-cleaning.

The objection to mandates is usually not that they are ineffective. Instead, it is that they can be difficult and slow to put in place due to the legislative process, and costly to achieve their goals. They are often inflexible, one-size-fits-all dictates for complex situations. “Everyone must have a heat pump in 10 years” is an example of an inflexible mandate, whereas increasing the price of gas relative to electricity gradually over 15 years is a market-based solution that more flexibly encourages people to find their own way to reduce gas use. People would switch earlier or later depending on their situation, and technology innovation would be encouraged.

A market can also be more politically feasible than regulation, especially if it looks more like “carrots” (incentives) than “sticks” (bans or restrictions). A farmer will be happier about saving water if you offer to pay for his (or her) water rights than if you tell him he has to decrease his water use.

The Hoover Institution is reliably pro-market, and some speakers at the conference also highlighted the fact that mandates can have unintended consequences. A ban on disposable bags will make pollution worse if people fail to reuse their reusable bags enough times. A requirement that all new cars be electric might induce people to hold onto their older, dirtier cars for longer. A ban on gas in new construction might make new construction more expensive and reduce the amount of new housing, or create a disadvantage for lower-income people.

But I don’t think that is a fair criticism. Markets can suffer from similar design problems. Some markets result in “perverse incentives”. If manufacturers are paid to reduce pollution, then without sufficient guardrails they might pollute more before the policy goes into effect in order to reap that benefit. Poorly designed pollution markets can also fail if they transact in “credits” or “offsets” that are only loosely tied to the contaminant at hand (e.g., carbon dioxide). Many carbon markets have done little to reduce actual emissions levels because of this problem. Inequality is another issue that can plague both mandates and markets, where the disadvantaged can be left behind if there isn’t sufficient focus on equity.

Markets for coal pollution provide a good case study for market design. Alissa M. Kleinnijenhuis is a research scholar at Stanford, and an enthusiastic proponent of using markets to reduce coal pollution in the developing world, where it is relatively cheap to buy. But she cautions that good program design is essential. If coal plants are purchased in one country, utilities there might just buy dirty energy from a nearby country that will burn more coal. So it is essential that renewables be put in when coal is removed, and that training is funded to facilitate the energy transition. Kleinnijenhuis points to recent agreements with Indonesia and Vietnam as showing a lot of promise.

So whether we aim to improve the environment with a mandate or a market, careful design is important.

David Victor, a professor of public policy at UCSB, made the point that mandates do not have to be slow and cumbersome. They are much easier to craft, pass, and administer if they are made narrower in scope. He is a big proponent of designing legislation for specific industries, or pollutants, or states, because these smaller coalitions have clearer parameters and can regulate more quickly. He points to a number of policy successes at large and unwieldy gatherings like the Conference of Parties that start small, with a focused group of motivated actors, and gradually expand out from there.

While mandates are canonically viewed as slow, inflexible, one-size-fits-all forms of policy, markets have their own set of issues. Several speakers brought up the “free rider” problem, which applies specifically to voluntary markets. If non-participants benefit from the participation of others, then there isn’t much incentive for them to participate. When someone in the audience asked about Stanford’s Natural Capital Project, which aims to put a price on nature so that it can be objectively valued in transactions, Stanford law professor Buzz Thompson was not very enthusiastic. He replied that, in his experience, pricing that relies on voluntary markets just doesn’t scale. “Those markets are anemic without a big government assist,” noting that most people don’t want to pay if everyone else isn’t paying. Presumably they assume that if it were really all that important, the government would regulate it.

Another problem with markets is that they may not be open to all participants. For example, an auction for drilling rights might be open only to oil and gas companies. Antiquated "use it or lose it" laws can prohibit environmental organizations from purchasing land for protection. (You can watch a helpful short video on that here.) Internationally, protectionist policies can limit a market to a subset of countries. Many speakers, including Victor and Thompson, spoke out strongly against these restricted markets. Open markets are more efficient. There is value to letting environmentalists participate in auctions and there are costs in limiting trade to specific countries. Thompson said he worries much more about market restrictions like this than he does about the free-rider problem. If everyone can participate, then more will do so, even with the free rider opt-out, and over time that will put pressure on others to participate.

Thompson is a trustee with The Nature Conservancy, and in that role and others he has had considerable experience with environmental markets. He has concluded that as much as we may relish the promise of free markets, government involvement is an essential element of nearly every successful market he has seen because of the problems described above.

He enumerates three types of environmental markets. The majority are regulatory markets, where a market exists because of a government mandate. For example, the government might say that you can’t build on a wetland without purchasing and protecting wetlands somewhere else. This type of market can be targeted at climate mitigation, air quality, land use, and so on. Cap-and-trade schemes are a canonical example, where a regulation or mandate is paired with a market to help achieve the mandate at lower cost.

The second kind of market that he enumerated is a more straight-forward payment for environmental benefit. Colorado pays farmers for their water rights, which it then allocates to streams to improve habitat for fish. California pays landfills for their biogas production. These markets would not exist if the government hadn’t opted to allocate funds for specific environmental purposes.

The third kind of environmental market, which is only 10-20% of all markets, is the voluntary market driven by private organizations. As an example, the Peninsula Open Space Trust takes donations to buy land to protect. But even these markets rely on government policies, as most donations would not be feasible without government support for tax deductions.

As Thompson summarized it, “Government has its fingerprints all over” successful environmental markets. So mandates vs markets is arguably a moot point, at least for environmental markets, because the markets rely on government regulation to succeed. Maybe the best solutions involve a little bit of each.

It’s interesting to take a look at a couple of environmental markets that were highlighted during the discussion.

Funding “Pop-Up Wetlands” for Migratory Birds

The Nature Conservancy has been partnering with the California rice industry and the state’s Department of Water Resources to support an innovative program that floods rice fields when waterbirds are migrating over the Central Valley. Scientists noticed that the birds were using the flooded rice fields during their migration, but the flooding didn’t always coincide with when the birds were passing by. In 2017 they piloted a program to pay farmers to extend the period during which their fields were flooded. As The Nature Conservancy describes it: “(We use) a reverse auction model where farmers offer their best price to create bird habitat. Then, based on the bids, we select farmers who provide the best habitat in the locations where the birds are most likely to land. These farmers then flood their fields, generating temporary habitat for migrating birds, and in the process, returning nutrients to the soil.”

The program has been popular, and even during the height of the drought, a number of farmers signed up, though with a higher price. CalMatters quotes one farmer as saying “We grow two crops: We grow rice and we grow birds.”

Waterbirds in flooded rice fields near Chico. Source: USDA

What’s interesting about this program is it shows how nimble a market can be, with prices adjusting based on water supply and farmer interest, and wetlands effectively rented rather than purchased. Economist Eric Hallstein estimates that the reverse auction costs about $20 million per year, whereas buying the land outright would cost around $4 billion.

But as one audience member pointed out, this program also highlights the fact that we aren’t charging enough for water to begin with. If the price of water incorporated the benefits it provides to wildlife, then the wetlands would not have disappeared to the extent that they have, and the migratory bird population would not need to be saved. Instead, this program ends up paying rice farmers so they can grow more rice, which you could pretty well argue we shouldn’t even be growing in this drought-stricken region. This is a type of “perverse incentive” described above.

Paying Ships to Slow Down

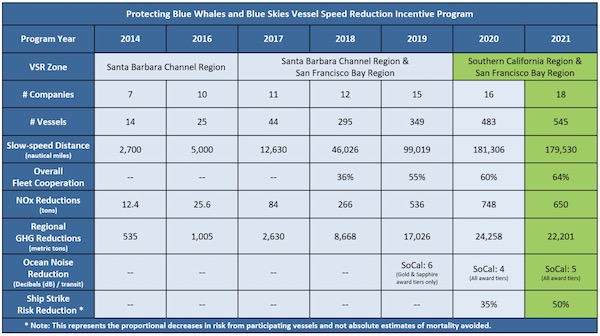

Fast-moving ships off the California coast emit a lot of pollution and kill a lot of whales. A program called Protecting Blue Whales and Blue Skies is designed to encourage ships to slow down to 10 knots or less, which significantly reduces emissions and whale mortality. In its first year, the program offered $2500 per transit for ships to slow down. Since then the program has evolved. Ships are asked to slow down in two key channels during the whale migration period from May to December. The non-profit WhaleSafe monitors the speed of ships in those channels and reports on the results.

Shipping companies that most consistently reduce their speed are recognized and promoted and given a reward ranging from $5,000 to $50,000, for a total program cost of $300,000 in 2021. Many large shipping lines are engaged, and some like Maersk are participating more for the recognition than for the money. In fact, over half of the eleven winning companies declined their payment this past year. Some say that this program aligns with the values of their own customers, and so it makes for good business.

This program has been very successful at reducing ship speed. In the southern California channel in 2021, 66% of miles traveled were at slow speeds, compared with just 21% in 2017. Administrators estimate they have reduced whale strikes by 50% and eliminated over 76,000 tons of regional greenhouse gas pollution that largely impacts local coastal communities. They have also reduced noise in the ocean that disturbs whale communication.

The program has improved air pollution and whale impact risk. Source: Protecting Blue Whales and Blue Skies

What’s interesting to me here is the numerous and local benefits that are gained from a small investment, and the success of administrators in promoting the program and the most engaged participants. As participation has grown, impact has grown, but the financial incentive is almost beside the point. What also strikes me here is that, despite this success, whale biologists would still like to see a mandate, with one suggesting that “instead of paying ships to slow down, we should just make them slow down.”

A spokesman for Maersk, which usually complies with the voluntary requests, alludes to the free-rider problem in expressing support for a mandate. KCLU reports Maersk’s Lee Kindberg as saying: “If you're going to have a regulation, enforce it. So that you have a level playing field and are not disadvantaging those companies that are trying to do the right thing by not enforcing. So the enforcement to us is a high priority.”

New International Maritime Organization recommendations on shipping routes go into effect this year, and while not technically enforceable by law, insurance companies expect compliance with such guidelines and ships almost always adhere. So the voluntary market is being succeeded by compulsory regulation, which seems like an effective sequencing of policies.

Paying Citizens to Protect Forests

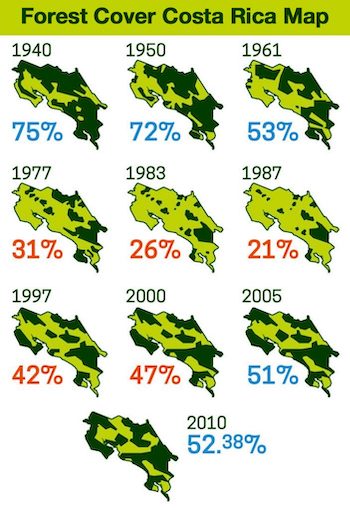

Costa Rica suffered from massive tree and habitat loss until it passed a law in 1996 outlawing deforestation, and shortly thereafter introduced an incentive program that would pay residents to nourish and protect forests, watersheds, and biodiversity. Financed by a tax on fossil fuels, the program invested $500 million over 20 years and made an enormous impact on tree cover.

Profitable eco-tourism increased as a result, further helping to motivate participation. When environmental benefits are aligned with economic benefits, people rally to the cause. Moreover, one of the benefits of markets like this is that they can attract investment beyond the scope of the intended audience. Because Costa Rica has developed forestry accounting infrastructure, it has earned World Bank and other funds for reducing its emissions by protecting its forests.

What’s interesting here, though, is that aligning economic and environmental interests is not always enough. Culture matters. The Costa Ricans have long had a passion for their natural environment, so a financial nudge in that direction worked well. A similar program would be more expensive, or even unaffordable, where the environmental tradition and cultural knowledge was weaker. Furthermore, Costa Ricans benefit from good governance, with a level of trust and transparency that is sufficient to encourage compliance. Markets cannot be effective when there is corruption, deception, and mistrust.

Conclusion

It’s clear that there are many ways to promote environmental responsibility, and it’s terrific to see so much policy innovation. It’s also clear that there is no one best solution, and it’s a mistake to argue that either markets or mandates are superior. Each can have awful results if poorly designed, and each can benefit from a blended approach, with markets reducing costs and mandates driving participation. In either case, it’s important to monitor the program for the results you want to see and to make adjustments if the program is not sufficiently effective. Politics can make this harder, but voters of all stripes appreciate the natural environment and enjoy time outdoors. Skillful politicians and thoughtful policymakers should be able to craft policies that appeal to voters, motivate participants, and are sufficiently measurable and adaptable to drive results. And it certainly helps if we can work together across parties on this.

Current Climate Data (December 2022)

Global impacts, US impacts, CO2 metric, Climate dashboard

Comment Guidelines

I hope that your contributions will be an important part of this blog. To keep the discussion productive, please adhere to these guidelines or your comment may be edited or removed.

- Avoid disrespectful, disparaging, snide, angry, or ad hominem comments.

- Stay fact-based and refer to reputable sources.

- Stay on topic.

- In general, maintain this as a welcoming space for all readers.