There is little disagreement that rooftop solar pricing in California is broken. Solar customers do not pay enough and non-solar customers are left footing the bill. The California Public Utilities Commission (CPUC) looked into fixing this back in 2016 but they were lobbied hard by the solar industry and a split 3-2 decision left the revised rate structure (NEM 2.0) largely intact while the CPUC promised to gather more data.

Well, more data has been gathered and it doesn’t look good. The CPUC reports that PG&E’s NEM 2.0 customers pay just 18% of their total annual cost of service, while SCE and SDG&E customers pay only 9% (Table 1-7). They conclude that existing NEM 2.0 installations will increase bills paid by non-solar customers by $13 billion over 20 years (Table 5-1).

Source: Background image from Pixabay

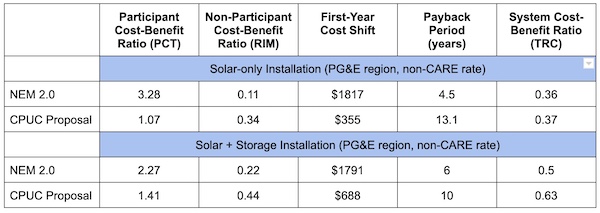

Analysts at energy consultant E3 looked at the “first-year cost shift”, which measures the amount of utility costs that are shifted from solar customers to non-solar in the first year after a system is connected. Their analysis showed that to be $1,817 for PG&E, $1,287 for SCE, and $2,448 for SDG&E (Table 16). To make matters worse, because solar customers tend to be well off, this represents a cost-shift from the wealthy to the less wealthy. The CPUC reports that “the costs of NEM are disproportionately paid by younger, less wealthy, and more disadvantaged ratepayers, many of whom are renters.”

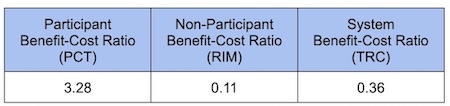

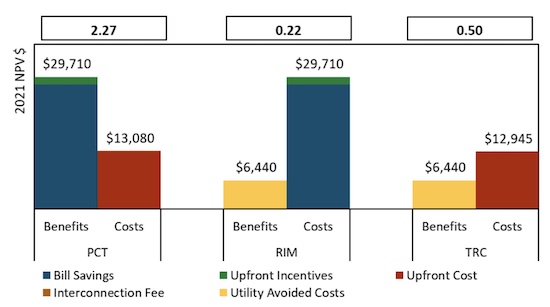

Yet another way to look at market distortions is with three other metrics that reflect how much solar customers, non-solar customers, and the system as a whole benefit: (2)

- PCT = Participant’s benefit-cost ratio (Participant Cost Test)

- RIM = Non-participant’s benefit-cost ratio (Ratepayer Impact Measure)

- TRC = Full system’s benefit-cost ratio (Total Resource Cost)

NEM 2.0 metrics for residential rooftop solar for PG&E, non-CARE rates. Source: E3 analysis, Table 4 (2021)

The first two columns show that those with solar do very well while those without pay more than their share. The third column indicates that residential rooftop solar overall is not cost-effective, costing more than the value it provides to our grid. (3)

When solar is coupled with storage the benefit is greater because it can provide more valuable energy (e.g., between 4-9pm). These paired systems have a TRC value of 0.5 to 0.69, compared to 0.36 without storage. Because the value of these systems is expected to improve as storage prices come down, the CPUC is much more interested in promoting solar+storage than standalone solar.

From what I can tell there seems to be little dispute about this analysis and its general conclusions. The disagreement is more about how to fix it. (4)

Why is the issue of solar pricing so contentious and difficult? One reason is that solar customers enjoy their cheap electricity and would like to keep it. That makes sense. In addition, the solar industry wants the utilities to maintain low rates so demand for their business stays high. In fact, state law requires that pricing ensures that “customer-sited renewable distributed generation continues to grow sustainably”. On the other hand, economists, rate-payer advocates, and the government want to see fair and cost-effective rates; in fact that is part of the CPUC charter. The priorities are inherently conflicting. The unhappy act of balancing these competing interests falls to the CPUC, which in 2020 began a lengthy process that resulted in its recently-announced proposed decision. I will go over that decision briefly, then share a few thoughts about what else may be behind the uproar over solar rates.

After the CPUC shared and reviewed the analysis summarized above, they asked interested parties to propose their own rate structures, using a framework provided by energy consultant E3. The CPUC encouraged plans that would align prices with costs and be fair for all customers, that would encourage electrification, and that would allow the industry to “grow sustainably”, especially in disadvantaged communities.

Nearly a dozen organizations developed fairly complete plans and many others provided partial feedback. E3 analyzed the submissions in a June report. The proposals fell largely into two camps, with the solar industry in one and rate-payer advocates and investor-owned utilities in the other. Two environmental groups were split, with the Sierra Club largely aligning with the solar industry and the Natural Resources Defense Council (NRDC) aligning with the rate-payer advocates and utilities.

Some of the questions that the plans needed to address were:

- How should solar customers be credited for energy they export to the grid?

- What should solar customers pay for electricity they import from the grid?

- How should solar customers pay for fixed costs (e.g., transmission and distribution) if they are using little net electricity? (5)

- How many years should it take to pay back a solar installation?

- How should we address the issue of equity?

- How should we transition to the new rate structure?

- Should any of this be retroactive to existing customers?

There was good agreement on some elements but wide disparities on others.

How should solar customers be credited for energy they export to the grid?

A big part of the problem with the NEM 2.0 rates is that solar customers are credited for energy they export to the grid using full retail rates, which are much higher than the cost the utility would otherwise incur for that energy at that time. Virtually all proposals suggested they be credited instead at “avoided cost” to better align costs and benefits and create a more accurate price signal. (6) This is where the CPUC landed with its proposal.

What should solar customers pay for electricity they import from the grid?

There was also good agreement on import rates, namely that solar customers should pay highly differentiated time-of-use rates, again to better align costs with benefits. The investor-owned utilities already offer such rates to some degree, though new rates could qualify as well. The CPUC agreed that requiring solar customers to be on these rates is the right approach, and cites PG&E’s EV2-A, SCE’s TOU-D-PRIME, and SDG&E’s EV-TOU-5 as eligible rates.

How should solar customers pay for fixed costs (e.g., transmission and distribution) if they are using little net electricity?

In California many fixed costs are incorporated into the per-kWh electric rates. If you aren’t using much electricity, you don’t pay much. Can these costs be better allocated to solar customers, whose systems rely on the grid and who often consume at peak times? There was a wide disparity of opinion on this. The investor-owned utilities argued for a substantial charge on solar bills to more appropriately allocate costs and avoid the cost-shift to non-solar customers, citing expenses like transmission and distribution, wildfire hardening, public purpose programs (e.g., CARE), and nuclear decommissioning. In contrast, the California Solar and Storage Association (CALSSA) claimed that this type of fee is neither just nor reasonable, and in fact is illegal.

For those supporting the charge, proposals ranged from $6/kW to $14/kW. The CPUC landed on a monthly “Grid Participation Charge” of $8/kW, but with no charge for low-income households. This charge would replace the existing “nonbypassable charge” billed to solar customers and eliminate the $10 minimum bill. CALSSA calls this proposal “draconian”, and the Grid Participation Charge remains a major point of contention.

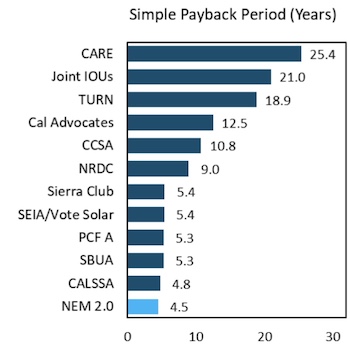

How many years should it take to pay back a solar installation?

The chart below shows the variation in “payback period” in the proposals, with the solar industry proposing much shorter payback times than the ratepayer advocates and utilities. All are longer than the current NEM 2.0 payback period of 4.5 years, shown in light blue at the bottom.

Payback periods advocated in proposals to CPUC. Source: E3 analysis, Figure 1 (2021)

The CPUC explained that it wasn’t interested in targeting a payback period for solar-only projects because these systems are not cost-effective for the grid. For a combined solar+storage system, which provides more benefit, they set their rates to target a payback period of 10 years. The solar-only payback in the CPUC proposal ends up being about 13 years for PG&E and SCE customers, and 7.4 years for SDG&E.

How should we address the issue of equity?

Solar providers argued that the best way to improve equity is to create more incentives to deploy solar for low-income households, while utilities said the best way is to lower rates for low-income households by addressing the cost shift. The CPUC opts to do both, adding some modifications to the rate structure to make solar systems more affordable for low-income households and setting up an Equity Fund to help pay for them. (7)

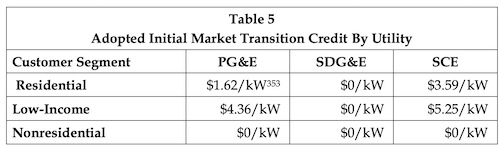

How should we transition to the new rate structure?

The solar industry suggested phasing in the new export compensation over time, while the utilities dismissed such a proposal as “a request to perpetuate the inequity caused by the current net energy metering program”. The CPUC concluded that “the magnitude and severity of the cost shift requires immediate action by the Commission”, deciding against gradually phasing in the new rates and opting instead to ease the transition with a small “Market Transition Credit” on the bill for a period of ten years, as shown below. This amount is only available to those who adopt the rate in the first year. After that it drops by 25% each year for new customers before phasing out entirely after four years.

CPUC’s proposed Market Transition Credit. Source: CPUC Proposed Decision (2021)

Should any of this be retroactive to existing customers?

This may be the most contentious element of the CPUC’s proposal. Solar companies warned that changing compensation for any existing customers would be “profoundly destabilizing” and “illegal”. But the ratepayer advocates and utilities felt it important to do more than just stop the bleeding, which is all that happens if the rate change is not retroactive. The CPUC agreed. As they put it: “The changes we have made thus far in this decision do nothing to tackle this existing cost shift. The changes only attempt to prevent or at least limit additional cost shift from new customers.”

The more aggressive advocates for rate reform suggested that existing customers should be switched to the new pricing 8 years after their system was installed, reasoning that was ample time to pay back their system, after which they would continue to receive bill savings albeit at the reduced new rate. The CPUC was more conservative, opting to give solar customers a full 15 years on their existing rate before requiring them to switch over.

That is pretty much the gist of the proposal. You can see in the table below that the cost shift is greatly reduced in the CPUC’s proposal, though still not zero. You can also see that the plan encourages storage (the PCT metric shows it is a better deal for participants), which is much better for the grid (see TRC column). (8)

Comparison of NEM 2.0 with the CPUC proposal for an installation in PG&E territory, non-CARE rates. Source: E3 analysis Tables 16 and 17 and CPUC Proposed Decision, Appendix B Table 2.

The outrage about this proposal surprised me -- in many ways it appropriately rights a long-standing wrong -- but in retrospect it shouldn't have. Solar customers have long understood that they are providing good, clean energy for California while also enjoying lower rates. They may have leaned into that by buying an EV or electric heater that they can operate at extra low cost. You can see why they would be upset at having their rates changed, even after a generous 15-year grace period. The solar industry has grown to support customer demand for these low rates and doesn't want the rug pulled out from under it. The CPUC’s 2016 decision to leave a misguided policy on the books just left more people to get more invested in it.

To compound the problem, there is not much of a lobby for non-solar customers. People don’t generally trust the big investor-owned utilities, who are among those spearheading this effort. Organizations like the Public Advocate’s Office and the The Utility Reform Network are doing their part, along with the Natural Resources Defense Council and a raft of economists. But they can easily be drowned out. This leaves the CPUC facing an uphill battle.

I’ve been trying to find the strongest policy arguments against the CPUC decision, arguments based not on personal interest but on the public interest. In the most widely-circulated arguments I’m seeing more emotion than fact, with misleading claims, few studies cited, and fewer proposals to rectify the problems they do see (e.g., distributed storage costs are still too high). Even Stanford Professor Mark Jacobson’s opinion piece in The Hill seemed mostly devoid of economics. (9) Instead it’s largely about the need to electrify.

I haven’t seen this argument spelled out, but I think one concern about raising rates for solar customers is that it is easier to electrify when electricity rates are low, and California’s prices are anything but. The brightest spot for electrification is in solar homes where rates are heavily subsidized. If we take that away, and instead just lower everyone’s rates slightly, the fear may be that the easiest case for electrification will disappear and we will lose our momentum.

I’m not convinced. Lower electricity rates certainly help to encourage electrification. But if that is the justification for the heavily subsidized solar pricing, then we should be more transparent about it and the rate structure should be tied much more closely to electrification than to solar. Moreover, there may be options for more widespread and equitable electrification. For example, the state could assume and then recoup in taxes more of the fixed costs of the grid, ideally assessing these more progressively than the utilities can easily do. Electricity rates would decrease significantly and be more equitable, while electrification would be accessible to many more people. UC Berkeley economist Severin Borenstein has been championing this for some time. I wonder if the state will have to do something like that anyway for our gas infrastructure as homes electrify and fewer households are left paying for it.

Final comments on the CPUC’s proposal are coming in and the final decision should be announced some time this month or next.

In the meantime, my advice for households concerned about climate change is to prioritize reducing your fossil usage over switching to rooftop solar. You can still save money while making a much bigger impact. Switch your car to an EV. Fly less. Get a smart thermostat that can save 10% or more on your gas bills. Try a heat-pump water heater and/or a mini-split to see your gas usage plummet.

If you also have or want to get a solar roof, fine, but consider adding storage. Evening electricity is the critical (and much more expensive) resource, and storage enables you to have power when you need it. A home battery also provides resiliency. It is very expensive so not accessible to everyone. But it is far better for the grid than a solar roof on its own.

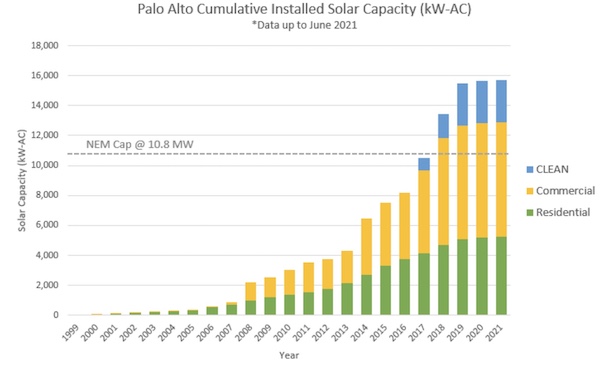

Palo Alto switched years ago to using “avoided cost” for solar exports. Residents who want solar roofs can still get them, but not at the expense of those who cannot or will not. The policy went into effect in January 2018 and adoption stayed strong for the first two years of the revised rate. It leveled off in 2020 and 2021, though it is difficult to tell how much of that was due to COVID delays or the city’s widely publicized permitting difficulties.

Solar capacity in Palo Alto has grown significantly since the city began using avoided costs for exported energy. Source: City of Palo Alto Utilities

Recently my neighbors in Palo Alto were discussing solar roofs on our neighborhood email list. One neighbor was expressing doubt that they paid off, having found that the marketed payback periods were overly optimistic. Another replied: “In truth, I believe if you are doing this to either be (1) “green" or (2) "save money", it's probably not worth it. Palo Alto power is already 100% renewable and we have the longish payback time. I'm not sure I believe it really makes any economic sense, and power failure avoidance is still probably a once in every "n" year thing. So, instead, the rock solid reason for doing solar comes down to: (3) want to.”

And there is absolutely nothing wrong with that when you are the only one paying for that decision.

Notes and References

0. The most relevant documents for this post are the CPUC’s Proposed Decision, the E3 analysis of the proposals and the existing rate structure, and the Lookback Study that analyzed the existing rate structure. I would also call out a body of work by Severin Borenstein and other economists at the Energy Institute at Berkeley’s Haas School of Business. This is their most recent blog post on this topic, which has many other links to their other posts. In addition, this post from NRDC and this post from the Energy Institute address many of the most common complaints about the CPUC proposal.

1. This blog post is exclusively about residential rooftop solar. The analysis for commercial rooftop as well as community solar is different.

2. This graphic may help to clarify the three metrics in question.

This illustrates how PCT, RIM, and TRC are computed. This figure depicts values for solar plus storage in PG&E, non-CARE rates. Source: E3 analysis, Figure 5 (2021)

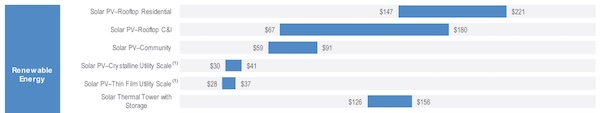

3. The chart below shows that, globally, the levelized cost of rooftop solar far exceeds that of utility-scale solar. The top row is residential rooftop solar while rows 4 and 5 are utility-scale. You can click through to the “Source” link for a clearer view.

Utility-scale solar is far cheaper than rooftop solar globally. Source: Lazard (2021)

4. The analysis was reviewed in depth as part of the CPUC proceedings and the avoided cost calculation undergoes annual review. There are still some lingering discussions about avoided costs -- there always are -- but that is generally not the focus of the debate.

5. Many of the largely fixed costs in California’s electricity grid are included in the volumetric (per-kWh) rates. This is partly what makes our rates so high, as I wrote about here. These costs include transmission and distribution, hardening against wildfires, public purpose programs (e.g., CARE), energy efficiency programs, and more. Currently solar customers pay a “nonbypassable charge” on each kWh they import in a given metered interval from the grid that covers some of this: the public purpose program charge, nuclear decommissioning charge, competition transition charge, and Department of Water Resources bond charge. The restrictions to metered intervals and imports-only constrain the amount collected, as does the limited set of programs covered.

6. Those of you who are Palo Alto residents may know that the City of Palo Alto Utilities already credits solar exports at avoided cost, having approved the change in 2016 and rolled it out in January 2018. The initial rate was $0.075/kWh, though it has been increased over time to $0.1078/kWh, largely because of increases in the cost of transmission and distribution.

7. More detail about this can be found in Section 8.6.1 of the CPUC’s Proposed Decision.

8. It may even be that storage on its own, without rooftop solar, could be a better value for the grid than solar + storage, but E3 did not analyze that option.

9. At the end Professor Jacobson pushes back against the per-kWh aspect of the Grid Participation Charge, saying that those who use the grid the least (larger installations) pay the most. It’s not clear to me that they use the grid the least (they may just have bigger houses). I am also strongly in favor of the wealthy paying a greater share of the fixed costs for our grid and this is a baby step in that direction.

10. It seems like residential rooftop solar would provide considerable value when it comes to reducing transmission or distribution costs. But studies show that is true only in certain places. If we were to distribute residential solar optimally, it could save money, but that is not what we do. You can find discussions about this here and here and here.

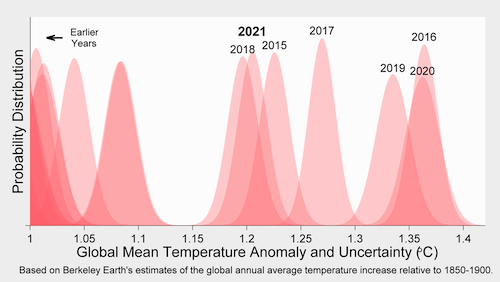

Current Climate Data (December 2021)

Global impacts, US impacts, CO2 metric, Climate dashboard

I expect you have already heard that the past seven years have been the warmest in recorded history. But a comment from climate scientist Dr. Zeke Hausfather that we will probably never again see temperatures as cool as we had before 2014 really struck me.

Source: Twitter

Comment Guidelines

I hope that your contributions will be an important part of this blog. To keep the discussion productive, please adhere to these guidelines or your comment may be moderated:

- Avoid disrespectful, disparaging, snide, angry, or ad hominem comments.

- Stay fact-based and refer to reputable sources.

- Stay on topic.

- In general, maintain this as a welcoming space for all readers.

Comments that are written in batches by people/bots from far outside of this community are being removed.