Will power providers be able to comply with the CPUC mandates?

To answer this question, and to understand more generally how these procurement mandates are impacting our local communities, I spoke with some of the people who buy power for our homes and businesses: Silicon Valley Clean Energy (SVCE) Director of Power Resources Monica Padilla; Peninsula Clean Energy (PCE) Director of Power Resources Siobhan Doherty; and City of Palo Alto Utility (CPAU) Senior Resource Planner Jim Stack. There have been several CPUC procurement requests lately, two addressing near-term summer reliability plus the one discussed in last week’s blog, so they had a lot to say. (2)

Monica Padilla (SVCE) and Siobhan Doherty (PCE)

SVCE’s Padilla, who has worked on planning and procurement for 30+ years, was up front about the challenge. “They are asking for so much capacity so fast. On top of that, we need many resources from CAISO (e.g., transmission) to integrate the new supply with the grid. We need so much labor, qualified labor. So much material. We have to get equipment to the US and California. And have it built by 2023-2024.”

The CPUC itself agrees that this is not easy, explaining: “Looking ahead to the summers of 2022 and 2023, there is the real potential for delays associated with procurement already underway …. For example, there are interconnection queue limitations, supply chain issues being faced as a result of the COVID-19 pandemic, high global demand for battery storage, and challenges with skilled labor availability for engineering and construction of new energy resources, all of which will impact LSEs’ ability to bring resources online in the coming two summers.” (3)

Fortunately our local power providers were not surprised by the CPUC requests. Peninsula Clean Energy was already procuring resources that are available during the critical “net peak” period (4-9pm). Doherty explains: “We have a mission to address climate change, and so we have long had a goal to be 100% renewable on a time-coincident basis. As a result, we haven’t had to change our purchasing plans much. In just the last three months we signed three relevant contracts -- two solar + storage, one wind. We are also nearing a contract for long-duration storage (8-hour battery) as part of a joint procurement with other community choice agencies.”

Peninsula Clean Energy plans to match supply to demand each hour. Source

Padilla said Silicon Valley Clean Energy had seen the “obvious” need for net peak capacity as early as 2017-2018, given the decommissioning of Diablo Canyon and several old gas plants. Power providers had been purchasing solar and wind to satisfy the renewable portfolio standards, but those resources weren’t addressing the high demand on hot summer evenings. SVCE began pairing solar with storage almost exclusively in a joint effort with Central Coast Community Energy. They also moved early to acquire some geothermal energy, one of the few “clean, firm” resources that are available at least 80% of the time. Ironically, much of this was acquired too early to count towards the new requirements, so SVCE will be contracting for more. (4)

Silicon Valley Clean Energy has contracted for $1.6 billion in long-term renewable energy projects. Source: SVCE

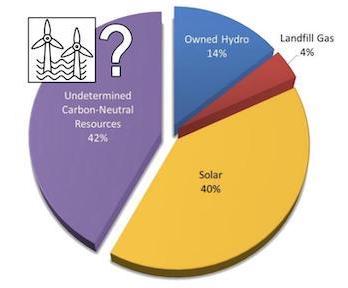

Jim Stack of City of Palo Alto Utilities clarified that municipal utilities are not subject to these CPUC requests, and moreover have only a five-year planning cycle rather than a two-year one. Palo Alto has no battery storage and in fact its power portfolio has been pretty static for the past five years. CPAU continues to re-evaluate its larger hydropower contract, which expires in 2024. The city’s hydropower dropped by about 50% this past year due to widespread drought, and climate change is generally making hydropower less reliable. Furthermore, Palo Alto’s larger (of two) hydropower resource is technically considered an import (it is not in CAISO), which CAISO does not prefer. Although the utility negotiated a better rate for the next few years, it may end up dropping that hydropower contract altogether for something with a complementary profile, perhaps offshore wind, though that won’t be online until the second half of the decade at the earliest.

Will Palo Alto be powered by offshore wind in 2030? Source (background chart only): CPAU

With the many requests coming in from CPUC, Doherty said that Peninsula Clean Energy has been soliciting offers for more supply. “We belong to a joint procurement agency that recently put out a request for offers for clean firm energy. In addition, just a few days ago we published a request for offers (on our own) pretty much looking for everything.” I asked how all of this procurement was affecting prices. “We’re definitely hearing that prices are going up because everyone is looking for the same resources,” she replied. “Plus there’s inflation, plus there are supply chain issues. It’s hard to separate.” Doherty gave an example of how the fast evolution of the grid also makes it hard to evaluate long-term contracts. The “Effective Load Carrying Capability” factors that quantify how much of a resource’s capacity will count towards the mandate (how much it addresses “net peak” demand) are only fixed for the next two years. Anything beyond that is just guidance. This can make it hard to determine how much a long-term contract will count towards the requirements and whether the contract makes sense.

Padilla was even more blunt about the impact of procurement mandates and related macro-economic issues on energy costs. “Prices are going crazy.” She pointed to challenges with the CPUC processes. “The Integrated Resource Planning (IRP) process (the standard two-year planning cycle) is designed to identify the least-cost paths. But what we are seeing now is some overwrite of that process with these procurement mandates. So maybe now it’s not always cost-effective. At minimum, we are seeing that the long-duration storage component of the request is not cost-effective. Is the IRP process broken? That is my take. Would we have procurement mandates if it were working?” She continued: “At Silicon Valley Clean Energy we care deeply about reliability. And we care deeply about affordability. So how do you price reliability? The consequences of failure are pretty severe. We can’t have rolling blackouts.”

Palo Alto’s Stack wondered if customers understand how expensive it is to make the system ever more reliable. “That was a 1-in-100 event in the summer of 2020. Should we plan for that, or can customers tolerate a few hours of outages? It would save so much money. We see transmission costs going up 5-10% every year because we’re building more of it and hardening it to fire. Soon transmission costs will be on par with the renewable purchases.” To counterbalance those rising costs, Stack is very enthusiastic about the upcoming smart meter rollout. It will help people to use energy at times when it is cheaper and keep down overall prices. He also mentioned the importance of siting new projects in places where adequate transmission is already available, or close by.

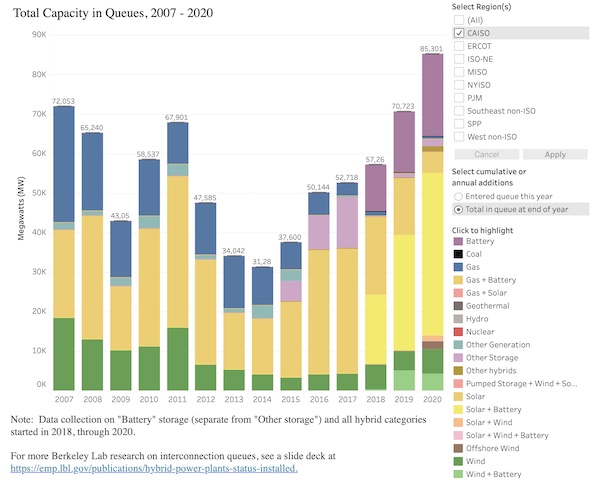

I asked the three power leads what they foresaw as the biggest risks to replacing Diablo Canyon with clean energy in the 2024-2026 timeframe, and more generally achieving the CPUC targets. All cited the difficulties of signing contracts and getting energy online in the few years available. Doherty and Padilla echoed Stack’s concern about transmission, not only costs but also delays. “We need to make sure that projects are moving through CAISO’s queue,” warned Doherty.

Data visualization of CAISO’s queue at end of each year. Source: Berkeley Lab

Padilla added that further restricted imports or more old gas plants going offline could also make it difficult to hit the goals. She emphasized that community choice power is a part of the solution, not a part of the problem. “While some people blame the CCAs (community choice agencies like SVCE and PCE) for reliability challenges, it’s just an unfortunate coincidence that we came about at the same time climate change created upheaval on the grid.” At this point, she said, “It’s a transition. Silicon Valley Clean Energy has signed $1.5 billion worth of purchase agreements, and these are real projects, ground has been broken. We aren’t going anywhere. We have huge investments in our community, and the local politicians are heavily invested. We bring a lot to the table. We are willing to negotiate, we have a faster approval process, and we have plenty of projects to choose from.”

A big part of the problem is that we are in uncharted territory when it comes to power planning. I once heard someone reflect that “We haven’t lived on this planet before;” that certainly complicates forecasting! What was a 1-in-100 year heat wave in the past might be a 1-in-30 year event today, and might soon be a 1-in-10 year event. We are planning for severe circumstances that we have never planned for before. Rapid procurement faces its own set of challenges, exacerbated by the pandemic. If you have time, read a few pages of the “Background” section in this recent CPUC document (starting at page 4, which is page 9 of the pdf) to get a sense of the state’s view. Among other things, it says (regarding the summer 2022 request): “Based on these realities, we expect it could be extremely difficult to actually identify and procure sufficient demand- and supply-side resources to reach 2,000 MW of online and available contingency resources for summer 2022, let alone the 3,000 MW target…. It may not be possible to reduce the risk to zero during an extreme weather event given the short timeline we face.” The CPUC’s reliability ask for 2024-2026 is four times larger and contains some particularly limited resource targets (e.g., geothermal). Hitting those clean energy marks will not be easy.

Nevertheless in my opinion it is the right thing to try. California’s ambition is laudable and its success is plausible because of the innovative and economic power of our state. The fast pace of clean energy development around the globe can work in our favor. California has many supply- and demand-side tools at its disposal (6), and the state is putting considerable effort into helping the load-serving entities to reduce power-sector emissions. I am optimistic that we will succeed. I do worry about the costs and wish I better understood the guardrails. That’s a good topic for another post. But there are many ways to limit and allocate costs, and it is past time for us to step up, reduce our emissions in earnest, and stop the damage we are doing to the planet and our future.

I look forward to your comments and questions.

Notes and References

1. Technically reducing demand (demand-response) counts as well, in which power providers ensure that a certain amount of demand shifts away from the peak period to other times.

2. I appreciate the time that Doherty, Padilla, and Stack spent talking with me. One of the many benefits of having local power providers is that they are closer to the community in which they operate, and they actively engage as such.

3. “Interconnection queue limitations” refers to a scarcity of resources for transmission planning. LSE = “Load-Serving Entity”, which refers to a power provider.

4. The CPUC currently allocates the asks based on the share of peak demand that power providers handle. They have also considered doing it based on their contract position, which would generally help the large investor-owned utilities that have been losing customers to the community choice providers.

5. Developer financing depends on customer credit ratings.

6. The state is still debating which resources they will allow to qualify for these mandates (e.g., will they allow some types of gas resources). Recently the state delayed the retirement of some gas plants so they could be available during summer heat waves as needed. It is certainly possible that the state could delay retirement of Diablo Canyon as well, but the economic case needs to be clear as the nuclear power is not flexible. It needs to run all the time and so will push the cheaper renewables offline when they are plentiful. Keeping the plant operating would also preclude offshore wind off the central coast from using Diablo Canyon’s transmission lines. I would anticipate no more than a 3-4 year extension for this nuclear power plant, if that.

7. The state is issuing periodic reports on procurement. A recent one for 2019's 3300 MW order can be found here. It reports that power providers have generally over-procured what is needed, though a few projects meant to come online by August 2021 have been delayed.

8. I appreciate the statement below from one of the CPUC’s 2019 decisions about power planning. The commission is aggravated that the newer/smaller power providers are treating gas plants like a hot potato when in fact they play a critical role providing power when we need it most. (LSE = “Load Serving Entity” = power provider; CCA = “Community Choice Agency”, typically a local power provider; IOU = “Investor-Owned Utility” = one of the three large power providers in the state: PG&E, SCE, and SDG&E).

“We also wish to make clear to all LSEs that there is a shared responsibility among all of them for a reliable electric system that meets the state’s environmental goals at least cost....The current market trends appear to show that a large proportion of the responsibility for operational needs still rests on the large IOUs, despite the fact that resource adequacy requirements apply to all LSEs now serving customers. While the IOU customers have historically shouldered the burden of reliability resources, particularly natural gas, the load is departing rapidly for alternative providers, particularly CCAs, and the responsibility has not appeared to shift proportionately. The IRP filings of the majority of CCAs are focused primarily, if not exclusively, on the acquisition of renewable and storage resources. While that is admirable and necessary, it is also the case that even by 2030, if we meet our GHG emissions goals, the need for natural gas resources to help support system reliability will not be reduced to zero. While we are focused on minimizing the operation of fossil-fueled resources to the extent possible, especially in disadvantaged communities, there will still be the need to contract with existing natural gas resources needed to maintain system reliability as well as affordable electricity in the state while this broader transition is underway. And that responsibility needs to be shared fairly among all of the LSEs serving load within the CAISO. It will not be sufficient or appropriate for new CCAs to lean on these resources procured by IOUs, and provide the public with messages about their cleaner resource mix, while focusing their resource procurement efforts only on renewable and storage resources.”

Current Climate Data (October 2021)

Global impacts, US impacts, CO2 metric, Climate dashboard (updated annually)

Comment Guidelines

I hope that your contributions will be an important part of this blog. To keep the discussion productive, please adhere to these guidelines or your comment may be moderated:

- Avoid disrespectful, disparaging, snide, angry, or ad hominem comments.

- Stay fact-based and refer to reputable sources.

- Stay on topic.

- In general, maintain this as a welcoming space for all readers.

Comments that are written in batches by people/bots from far outside of this community are being removed.