In the “olden days” (up to about twenty years ago), a single utility would be responsible for an area, and would dial up (or down) its supply to meet demand. It owned all the power plants and transmission lines needed to do that. Now in many areas of the country, including ours, we have allowed for more competition and more resource sharing, to increase reliability, decrease prices, and spur innovation. So the job of matching supply to demand now falls to an “energy market”, which in our case is CAISO.

Similar to the monolithic utilities of old, these markets have been forecasting demand and meeting it with (flexible) supply. They do long-term demand forecasts (a year or more) to assess infrastructure needs. And they do shorter-term forecasts, including the important day-ahead forecast, which is typically within 1-3% of actual demand. Power suppliers place bids, and the lower bids are scheduled to run. These bids can be placed in the day-ahead market, or in the real-time market. That market is evaluated every five minutes throughout the day, and picks up the difference between actual demand and what was forecast a day ahead.

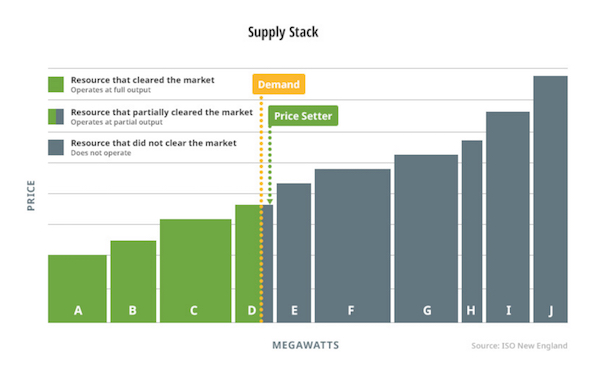

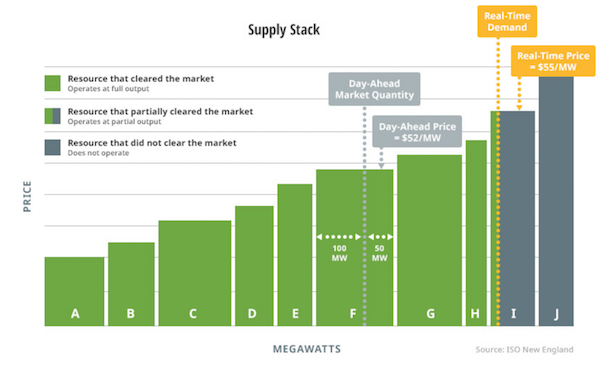

Here is what that looks like. In the case shown below (charts are from this market writeup), the market has ten power plants that have put in day-ahead bids, and it meets demand based on price. The cheapest four are set to run, and the price is set at the most expensive of the operating plants.

Every five minutes the market reevaluates the price. If demand is higher than forecast, then additional plants will be called on, and they will set a higher clearing price for the entire market. In a similar fashion, if there is too much supply, fewer plants will be called on to run, and the price will be lowered. (3)

Why am I telling you all this, and what does it have to do with climate?

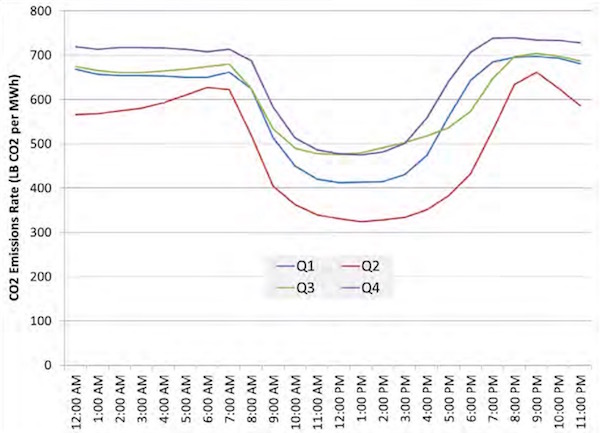

As you hopefully remember from the last blog post, the best time to charge your EV is in the middle of the day. It’s not even close. Look at how much CO2 was generated for each MW of power throughout the day, on average, for each quarter of 2018. The average emission rate is uniformly high outside of the midday hours. For much of the year, charging your EV at night is like filling up with 70% natural gas.

Many of you were probably pretty bummed (exasperated?) by that blog post. Maybe you drive to work and can’t park your car at a charger during the day. You might be able to “fill up” during the day on a weekend, but maybe you are driving around then too. What can you do, short of getting your own rooftop solar coupled with a car-sized battery to plug into at night? There is hope.

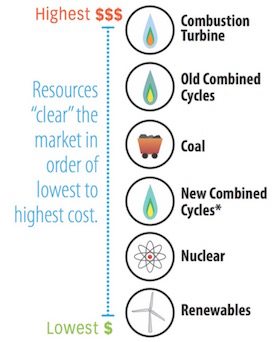

People love to make money on markets. “Buy low, sell high” is an aphorism you may be familiar with, and it is no less true with the power market than any other market. In fact, because the power market is relatively new and quickly changing, there are arguably more opportunities to make money than in a typical market. There is considerable price variability, several markets in which to trade, and relatively little competition. Why does this matter? The beauty is that price often corresponds with emissions, and that is true even when renewables are out of the picture, due to variability in non-renewable plants. Here is a diagram showing power resources from most expensive to least expensive. You can see the correlation with emissions. (4)

So organizations trading on the power market with the goal of making money are also, as a nice side effect, lowering emissions. How does this work?

Throughout the day there is some variability in prices as different power plants come online. Events occur that result in a drop in supply, such as congestion on a portion of the grid or a power plant going offline. An auxiliary power plant will start to ramp up. The power from these responsive “peaker units” is higher priced and often fairly dirty. So we see transient price (and emission) spikes. Here is what that looks like, with real-time pricing on top, compared with the day-ahead pricing below, from May 14. (5) A “normal” price would be between $20-$50 per MWh, but you can see spikes up to $1000 per MWh on the real-time market!

Money can be made, and emissions avoided, by bypassing these expensive (and dirty) spikes as they occur with flexible demand.

What is flexible demand? It is an electric load that can be decreased or moved to another time. Have you ever heard of a program where a utility offers to control your thermostat or air conditioner in return for a lower rate? The utility is doing this so they can turn down your AC and save money when there is a spike in price. The fastest growing source of flexible demand in this area is the electric vehicle, representing an enormous load without a fixed charging schedule. A 30-amp level 2 EV charger, which would charge a typical electric car in about 4 hours (6), is like running two central-air units at the same time. A Tesla super-charging station would be like running 40 (!) of those units at the same time. Since charging schedules often have flexibility, there is money to be made (and emissions to be saved) with EV batteries!

No, I’m not suggesting you stand by your charger and plug and unplug your EV based on the grid prices. Fortunately, technology can do that for you, such as that built by a local company, eMotorWerks, based in San Carlos. Using both their own JuiceBox smart chargers and a platform they have built that can be integrated into other chargers, they are able to aggregate these EV charging loads into virtual batteries that charge less when prices are high and more when prices are low.

Val Miftakhov, CEO and founder of eMotorWerks, is enthusiastic about the simple but powerful concept of flexible demand. “This kind of optimization can effectively double renewables penetration, simply by shifting demand away from high-emission and high-cost supply.” The virtual battery earns revenue for his company by competing on the market as a flexible demand resource. Customers can specify a minimum charge and a charging window, which the optimizer respects. A typical delay might involving postponing a 7pm charge during a spike in the after-work ramp to later in the night. Some customers may receive discounted chargers or rebates by participating. And utilities that sponsor this program can also benefit financially. In a nutshell, all parties can benefit: the environment, the customers, the utilities, and the company.

eMotorWerks today is operating a 35 MW virtual battery on both the day-ahead and real-time markets in California. As an example of their operation, in a recent month they bid on 1000 hours of excess renewable power, receiving $50/MWh. Take a look at these market graphs from May 15. Prices dipped into negative territory in the afternoon, so purchasing then would result in an income(!) of around $20/MWh. So even though eMotorWerks isn’t selling power, just by being judicious about when they purchase power (“avoid high, buy low”), they can make money and lower power costs.

And remember, this not only reduces our overall costs, it reduces our emissions. Starting in November 2016, Sonoma Clean Power deployed around 2600 JuiceNet-enabled smart chargers at no cost to consumers, and has saved over 7100 metric tons of GHG emissions. That is the equivalent of the total transportation emissions of about 160 households in that area over the same time period. That is a big difference for an essentially invisible change. Other areas are looking into this as well -- eMotorWerks is running trials in Colorado, Minnesota, and Europe. They are also testing a JuiceNet integration with Honda, in which the cars themselves would implement optimized charging.

Prices are not perfectly correlated with emissions. We know that because night and day prices are similar even though emissions are much higher at night. (8) So the rule of thumb to charge midday still holds. The JuiceNet platform is flexible enough to optimize more tightly to emissions for those who choose to do so. eMotorWerks gets real-time emissions data from the energy non-profit WattTime, and can use that as well as price to schedule charging times. It costs $50 extra for this enhancement to the charger, presumably because eMotorWerks will make less money from it, but “JuiceNet Green” is a great option for those who want to prioritize emission savings.

Christy Lewis, an analyst at WattTime, says that “interest in these time-shifting technologies is skyrocketing. People in the industry are beginning to recognize that this level of granular load-shifting is a necessary component to our high-renewables future, especially as we electrify buildings and transportation. eMotorWerks is leading the charge in this field, and we expect to see many others across multiple industries follow suit.”

There is no shortage of opportunity in this area. The difficulty, Val suggests, is in the bureaucracy needed to move forward on the ideas. The grid has long been open to integrating EV batteries, but implementing the ideas has been slow going. “For example, each customer currently requires a process with over 20 steps to participate in CAISO. We have a whole section of our company devoted to energy market participation and providing grid services. This process was designed for large resources, but could have great potential for smaller distributed resources.”

There are several other ways to use EV batteries to address the needs of our power grid, which I will cover in a later post.

Notes and References

1. Yes, electric signals do travel that quickly through transmission lines. The speed for a signal to travel between San Francisco and Los Angeles would be measured in thousandths of a second.

2. There is some tolerance for error, in that very small frequency changes can absorb some imbalance. But frequency must be kept within a very narrow margin, and in fact there is a “frequency regulation market”, often powered by batteries, that acts every few seconds.

3. Some power plants cannot respond easily to changes in demand. These plants aim to keep prices low and run at a steady pace. Nuclear and geothermal are an example of this. Gas plants and some hydropower are more likely to respond to load, and are referred to as “load following” plants. So-called “peaker plants” run only at times of high demand. Because they run infrequently, they are not built to be particularly efficient. They are dirty and charge high prices. The more we can avoid them, the greener our power. Indeed, they are slowly being phased out as battery storage comes on line. Battery storage is cleaner, can be built closer to demand, and has prices that are increasingly comparable.

4. Coal is often an exception, as it is very dirty but can be inexpensive. Fortunately it is rarely available in California.

5. This screenshot and the one below were taken from the EV JuiceNet app.

6. A “typical” EV with a 100-mile or so range might have a 30 kWh battery. (Some Teslas have 100 kWh batteries, while a plug-in hybrid might have a small 8 kWh battery.) The load on the grid depends on how fast you charge it. Some cars, particularly older EVs and those with small batteries, will limit charging power to 3.3 kW. But a “typical” car today will support a 6.6 kW charge (via a level 2 30-amp charger). The largest Teslas can take up to a 150 kW charge (via the supercharging network).

7. Interested in learning more? Next10.org has a recent series of articles on the California grid, and one specifically on EVs. FERC has also written a lengthy primer on the energy market, from November 2015.

8. This writeup has excellent graphs of price vs marginal emissions for the year 2017 on pages 7 and 8.

Current Climate Data (March/April 2019)

Global impacts, US impacts, CO2 metric, Climate dashboard (updated annually)

Comment Guidelines

I hope that your contributions will be an important part of this blog. To keep the discussion productive, please adhere to these guidelines, or your comment may be moderated:

- Avoid disrespectful, disparaging, snide, angry, or ad hominem comments.

- Stay fact-based, and provide references (esp links) as helpful.

- Stay on topic.

- In general, maintain this as a welcoming space for all readers.