High mortgage interest rates and rising home prices have led to a continued decline in California home sales compared to 2022, and local Realtors don't expect much to change for the remainder of this year.

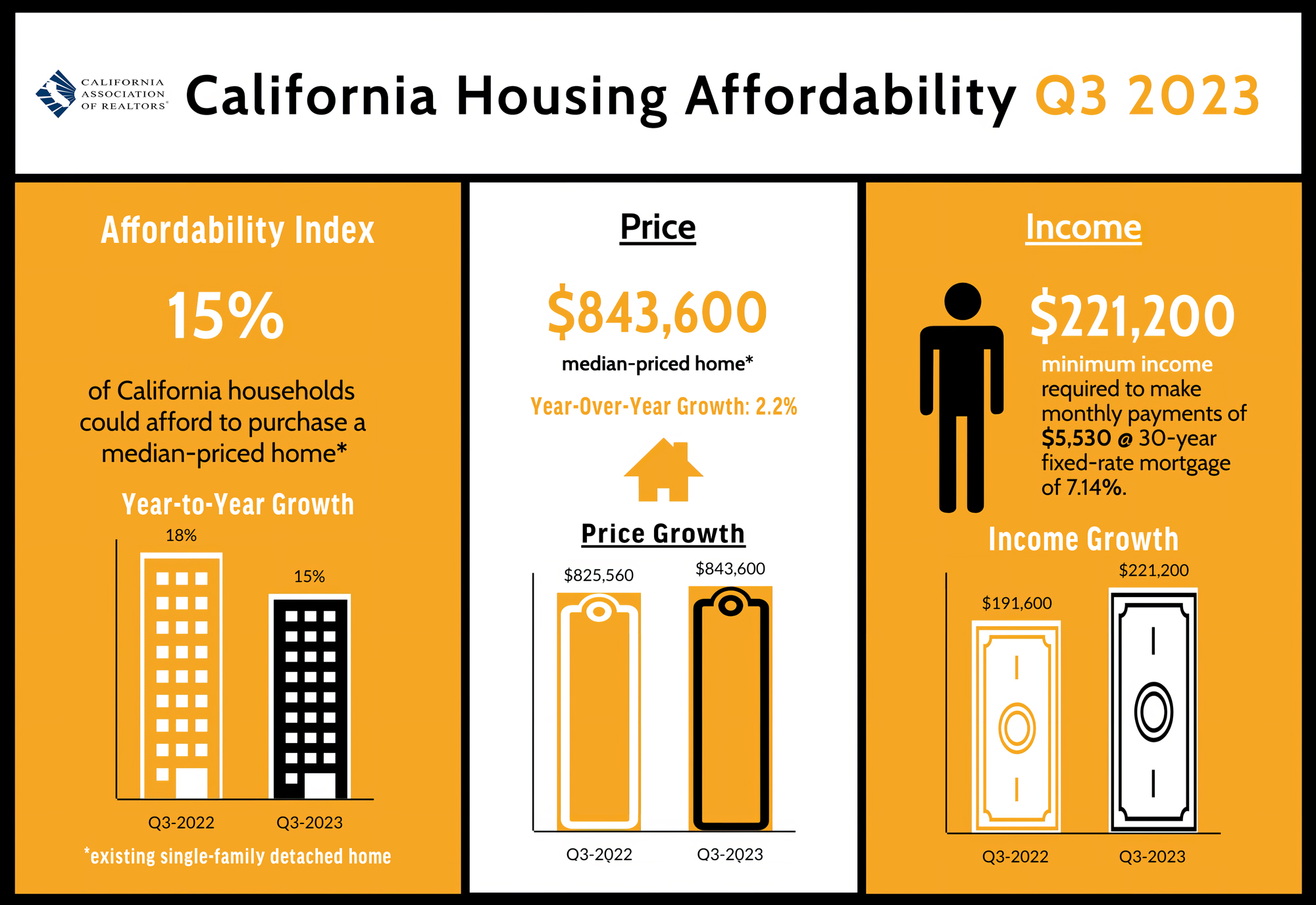

Housing affordability dipped to its lowest point in 16 years during July through September of this year with only 1-in-5 homebuyers able to afford a median-priced, single-family home, according to the California Association of Realtors' Third Quarter Housing Affordability Report. And in October, sales remained essentially flat while the median home price increased -- again.

The association reported last week that October sales of single-family homes in California rose 0.3% in September, but were down 11.9% from the same time last year, when 274,410 homes sold.

October also saw prices rise for the fourth straight month with the statewide median reaching $840,360, or a 5.3% increase from $798,140 a year ago. The price jump is the largest year-over-year gain in 17 months.

“A sizable jump in interest rates kept home sales constrained in October and will likely hamper home sales for the remainder of the year,” Jennifer Branchini, president of the California Association of Realtors, said.

Peninsula remains resilient to price increases

In the San Francisco Bay Area, year-over-year sales fell 3.9%, with half of homes on the market selling above their asking price in Alameda, San Francisco, Santa Clara and San Mateo counties, according to the California Association of Realtors.

In San Mateo County, October home sales rose 1.9% from the same time last year but were down 2.2% compared to the previous month. The county’s median home price was $2.1 million, an increase of 10.5% compared to October 2022 when it was $1.9 million and a 7.4% increase compared to the previous month of September when it was $1.95 million. Homes stayed on the market for an average of 12 days.

In Santa Clara County, October home sales were down 1.3% from the same time last year and up 7.3% from the previous month of September. The county's median home price was $1.805 million, an increase of 11.1% compared to October 2022 when it was $1.6 million. and it dipped 2.6% compared to the previous month of September when the median price was $1.85 million. Homes stayed on the market for an average of eight days.

“It’s evident that demand hasn’t slowed much in the Bay Area, as home prices remain strong and homes continue to sell over list price. It’s the lack of homes for sale that is bringing down sales volume,” Jim Hamilton, president of the Silicon Valley Association of Realtors, said. "According to MLSListings, homes in San Mateo County sold a median 103% over list price, and in Santa Clara County, they sold 105% over list price. As we enter the traditional seasonal slowdown, we may see even fewer sales and some prices may level off.”

Higher home prices and elevated mortgage rates continue to be the primary factors that have kept housing affordability near the all-time low across most counties, Hamilton added.

"It’s concerning when only 17% of homebuyers can afford a median-priced home in both San Mateo and Santa Clara counties, ” he said.

Hamilton said much of next year’s housing outlook depends on whether or not the Federal Reserve decides to stay the course and pause its interest rate hikes, and hopefully eventually cut rates, which would benefit the housing market.

"Easing mortgage interest rates will certainly be good news for both buyers and sellers,” he said.

The 30-year fixed mortgage interest rate averaged 7.62% in October, up from 6.90% in October 2022, based on Freddie Mac’s weekly mortgage survey data.

Amid higher interest rates, the California Association of Realtors expects positive year-over-year price growth to remain throughout the rest of the year as housing supply is projected to be tight in the coming months.

Silicon Valley Association of Realtors (SILVAR) is a professional trade organization representing 5,000 Realtors and affiliate members engaged in the real estate business on the Peninsula and in the South Bay. SILVAR promotes the highest ethical standards of real estate practice, serves as an advocate for homeownership and homeowners, and represents the interests of property owners in Silicon Valley.

The term Realtor is a registered collective membership mark which identifies a real estate professional who is a member of the National Association of Realtors and who subscribes to its strict Code of Ethics.

There's more ...

Looking for more real estate stories? Read Embarcadero Media's latest Real Estate headlines.

Comments