Santa Clara County may be about to experience one of its worst declines in property value in 15 years.

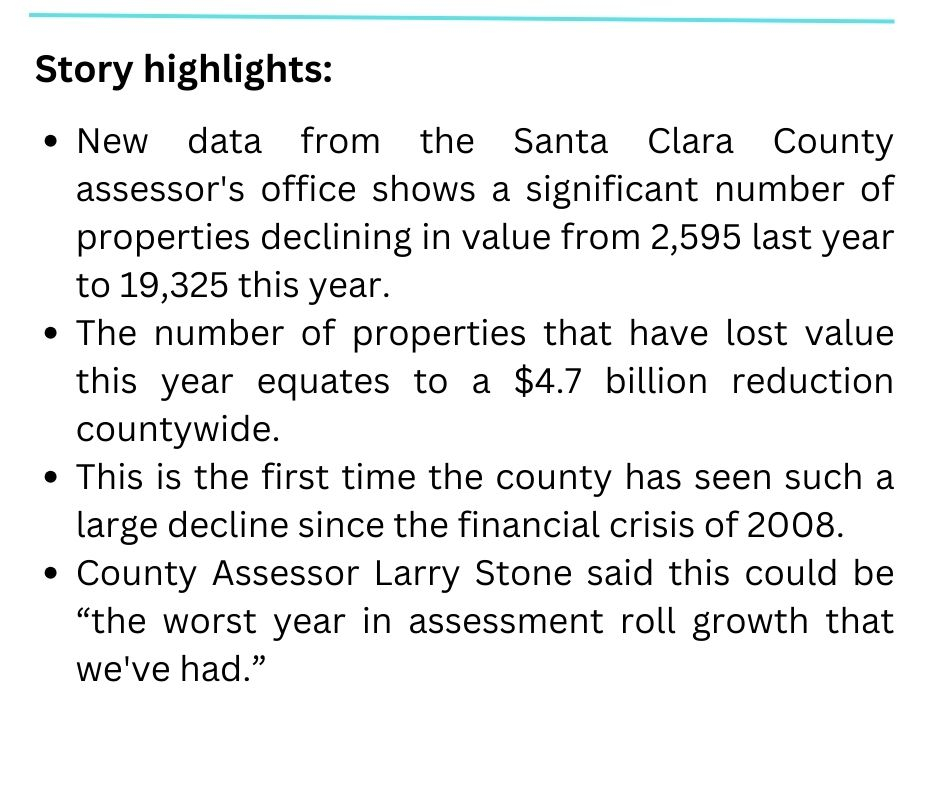

New data from the Santa Clara County assessor's office shows a significant number of properties declining in value from 2,595 last year to 19,325 this year. Aside from a brief uptick in 2020 during the first year of the COVID-19 pandemic, this is the first time the county has seen such a large decline since the financial crisis of 2008, County Assessor Larry Stone told San Jose Spotlight.

"The local economy and real estate markets have largely for the last nine years, (except during) the COVID year, been strong," Stone said, who's been the county assessor for 29 years. "I don't think economically the Fed's definition of a recession is in existence yet ... (but this year) has a very strong opportunity to be the worst year in assessment roll growth that we've had."

The sharp increase in the number of properties that have lost value this year equates to a $4.7 billion reduction countywide, which the report largely attributes to residential properties. The number of residential sales in the 2022-23 fiscal year declined by 29% from the year prior, yet the median sale price of a single-family home increased.

Stone said when interest rates go up and inflation occurs, housing values drop. Interest rates are so high, hovering around 8%, that property owners aren't selling because they would be buying at a much higher interest rate, he said. Yet Silicon Valley job growth and incomes have steadily risen, even through COVID, he said.

"The lack of inventory is causing sales prices to stay up and in the last couple of months increase, which is strange," Stone said. "It's different than you'd find in a normal economic situation. Too much money chasing too few homes."

Stone said a continued downward trend has him concerned about the future impact on funding public education -- 51% of all property tax revenue is allocated to school districts. Public schools, along with local governments, are facing the end of COVID stimulus dollars that injected millions into schools.

"Education has not revived itself from COVID," Stone told San Jose Spotlight. "It's been even worse for public education and school kids than it has for industry and individuals. That's the major concern."

As a whole, the value of all real estate and business property in Santa Clara County jumped by nearly $41.2 billion last year, despite a contracting market in the latter half of 2022. That's a 6.6% increase over the prior year.

The report lists the top 10 commercial taxpayers in the county for 2022-23. Among them are Google, which ranked No. 1 paying $117 million in taxes, or 1.5% of its $9.5 billion in assessed property value. Pacific Gas and Electric came in second, paying $86.8 million in taxes. The report shows an unprecedented 9.6% increase of $47 billion in business property value -- second to only Los Angeles County -- driven largely by increased costs of acquisitions and continued inflation.

"That's one of the things that actually moderated the decline in 2022," Stone said. "Our business property (value) was substantially greater than we thought -- it was a surprise ... inflation caused the values of the (business properties) we were assessing to go up."

This story, from Bay City News Service, was originally published by San Jose Spotlight.

Comments

Registered user

Old Mountain View

on Oct 27, 2023 at 1:12 pm

Registered user

on Oct 27, 2023 at 1:12 pm

Wait, wasn't there reports that the real estate market was STRONG?

Registered user

another community

on Oct 28, 2023 at 12:35 pm

Registered user

on Oct 28, 2023 at 12:35 pm

The assessor's full report for this year is not even out yet. The San Jose Inside piece is mixing up years with some facts from different years. The facts cherry picked are misleading. The conclusion of this article is off as a result. See Web Link for the media release that occurred back over 3 months ago on July 3rd.

2023 Assessment Roll Growth at $41.2 billion in spite of

fewer property transfers and proactive reductions of

19,000 Properties

So besides the 19,000 properties that were dropped in value, enough else happened that the net result was $41 Billion growth. This does not yet at all reflect what is happening regarding sales and value changes during 2023, but only the valuations as of the start of this year.

It's really weird to see San Jose Inside's error be copied in the Voice!

Registered user

another community

on Oct 28, 2023 at 12:50 pm

Registered user

on Oct 28, 2023 at 12:50 pm

Another error is that the 19,000 properties that dropped in value are not close to $4.7 Billion in declined value. The $4.7 Billion figure in the press release refers to something completely different.

What the press release does say is that while 19,000 properties in Prop 8 decline status were proactively reduced for the current tax year the total impact of this was $2.8 Billionm which was offset by ~20 times more value increases.

Registered user

Old Mountain View

on Oct 29, 2023 at 10:05 am

Registered user

on Oct 29, 2023 at 10:05 am

I read the website sited above. But that does not mean it is accurate regarding growth of real estate. Most properties in Mountain View on Zillow are having price cuts. Remember that report was done in July at best meaning it was using data from Q1 2023. By then there has been a lot of changes.

And also remember, this is a forecast, it is not real regarding the future values. Given that more layoffs are occurring and more businesses are closing offices, there is not a good trend to look forward to. As population declines go a 0.3% decline in population means a decline in demand. But at the same time we are completing record numbers of new housing.

But now we have record numbers of housing not even listed. Because the market is trying to prevent more value loss. The fact that the market lost value in this situation is showing it may actually be much worse.

Registered user

another community

on Oct 31, 2023 at 3:27 am

Registered user

on Oct 31, 2023 at 3:27 am

To quote from the Assessors Press Release about the market value changes based on the date Jan 1 2023

"The leading contributors to the increase in property assessments are changes in ownership and new construction, which accounted for $21.5 billion and $6.8 billion, respectively. Historically high business property values added $4.7 billion."

There were a lot more properties with increases than there were with decreases, over the course of 2022.

"This year’s roll includes 19,064 properties in Proposition 8 decline status, totaling $2.8 billion. Of those,98 percent are residential properties, a majority of which qualified for a reduced assessment due to lateterm decline in residential market values."

For the minority of properties with a decline in value, their total valuation (NOT THE DECLINE) was $2.8 billion.

So man, the headline of this article is ENTIRELY WRONG!!!!!

Registered user

Old Mountain View

on Oct 31, 2023 at 10:07 am

Registered user

on Oct 31, 2023 at 10:07 am

Again, you are talking about data that is 10 months old.

You need to get ready for the real drop off. That has already started.

Registered user

another community

on Oct 31, 2023 at 1:01 pm

Registered user

on Oct 31, 2023 at 1:01 pm

An important point is that San Jose Inside made blatant errors in reporting what the county assessor's office released to the public.

(a) they over stated the amount involved in the valuations of the properties that decreased (the very small minority that did so).

(b) They conflated the total final appraised value of the 19,000 properties in temporary reduced valuation state with the actual change in valuation caused by those temporary valuations

(c) they overlooked the fact that there was actually a huge rise in the total assessed valuation in the county

Registered user

Old Mountain View

on Nov 1, 2023 at 9:40 am

Registered user

on Nov 1, 2023 at 9:40 am

I just ask this, if it was that erroneous, where is the retraction?

San Jose Spotlight also reported it.

To me what you are simply saying is you cannot believe it.

The real pain will be the shortcomings of property tax revenues.